FAQ

-

Do I really need life insurance?

If others depend on your income (e.g., spouse, children, dependent parents), or if you have debts that others would be responsible for if you die (like a mortgage or co-signed loans), then life insurance can provide crucial financial protection. Even if you're single, it can cover final expenses and prevent your family from being burdened.

-

How much life insurance do I need?

There's no one-size-fits-all answer. Common rules of thumb include multiplying your income by 10, or using the D.I.M.E. formula (Debt, Income, Mortgage, Education) to calculate all your financial obligations and future expenses. Consider how much your loved ones would need to maintain their lifestyle, pay off debts, and cover future costs like college tuition or funeral expenses.

-

What are the main types of life insurance?

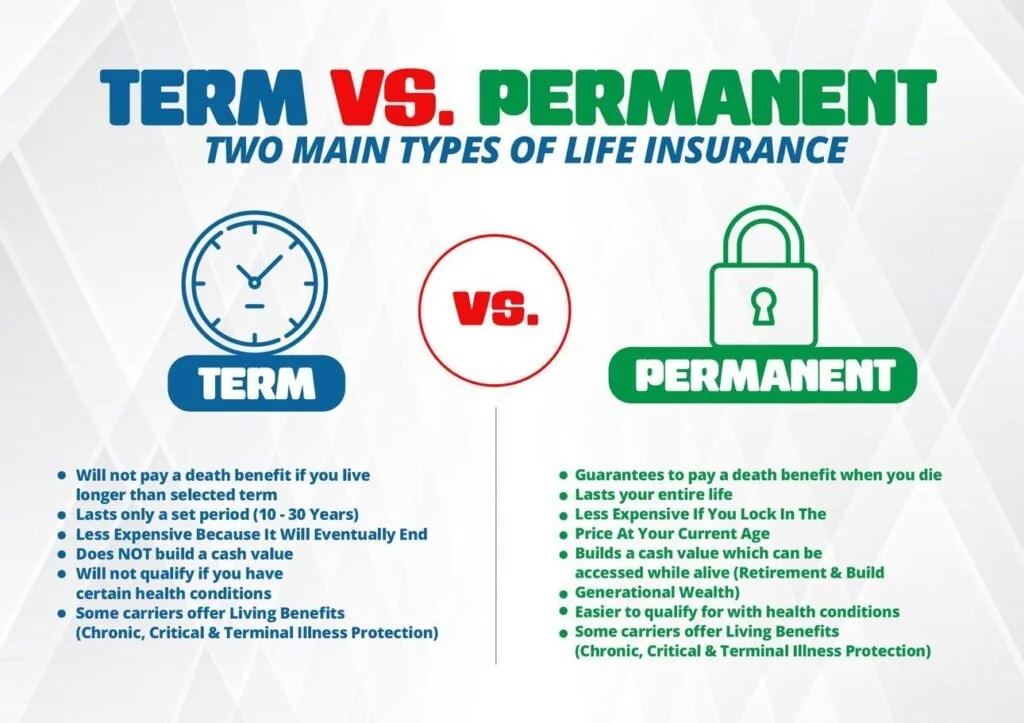

The two primary types are:

Term Life Insurance: Provides coverage for a specific period (e.g., 10, 20, or 30 years). It's generally more affordable and pays a death benefit if you die within the term. It typically doesn't build cash value.

Permanent Life Insurance: Provides lifelong coverage as long as premiums are paid. This category includes types like whole life and universal life. Permanent policies often build "cash value" over time, which can be borrowed against or withdrawn.

-

How much does life insurance cost?

The cost varies significantly based on several factors, including your age, health, lifestyle (e.g., smoking), the type of policy you choose, and the coverage amount. Generally, the younger and healthier you are, the less expensive it will be.

-

Will I need to take a medical exam?

For many life insurance policies, particularly those with higher coverage amounts, a medical exam is typically required. This exam usually includes checking your height, weight, blood pressure, and taking blood and urine samples. Some policies, like Farmers Simple Term or Graded Death, do not require a medical exam but often come with higher premiums or lower coverage limits..

-

What happens if my circumstances change (e.g., new job, marriage, children)?

Life insurance is a long-term commitment, and your needs can evolve. If your circumstances change, it's wise to review your policy. You might need to adjust your coverage amount, change beneficiaries, or consider different policy options to ensure it still meets your family's financial needs. Some policies offer flexibility to increase coverage or convert to a different type of policy.